Losing Money on Site? The Critical Mistake Too Many Construction Companies Make

Maximize Profitability on Your Construction Projects

Too many contractors win large construction contracts but fail to predict the actual profits. Without proper financial planning, big projects can lead to even bigger losses. Here's how to avoid that.

The Problem: Financial Risk on Large-Scale Projects

In the construction industry, winning a high-value contract is just the beginning. Many contractors struggle to calculate their profit margins accurately. A lack of financial insight can turn a golden opportunity into a financial disaster. This is especially true when contractors focus solely on project revenue without understanding associated costs.

Profit or Loss: There's No Middle Ground

At project completion, the result is either profit or loss. Even a break-even point represents a loss of opportunity, time, and resources.

Why It Matters

- Profit: Knowing your margin helps avoid financial overestimation and poor decisions.

- Loss: Early detection allows for strategic actions—change orders, scope reduction, or cost-cutting.

What Is a Forecasted Income Statement?

A Forecasted Income Statement (Provisional Operating Account) is a key tool to estimate income vs. expenses before starting a project. It provides a clear financial outlook and helps prevent cash flow issues at project completion.

Key Features

- Estimates net income or loss before starting

- Includes all tax-free revenue and costs

- Supports strategic decision-making and risk management

Track and Optimize Project Profitability with PROTRACKBTP

PROTRACKBTP is a cloud-based construction management software designed to simplify financial tracking and maximize project profitability. Monitor real-time margins, compare actual vs. forecasted figures, and adjust your strategy with data-driven insights.

Benefits of Using PROTRACKBTP

- Automated calculation of expenses and revenues

- Real-time monitoring of profit margins

- Collaborative dashboard for all project stakeholders

- Automatic generation of operating statements

- Comparison between actual and forecasted results

Practical Example: Construction Site Case Study

Let’s consider a contractor who wins a public works contract that includes both general building works and utility infrastructure (roads, drainage, water supply, etc.). The total value of the project is 230,158,988 CFA Francs including taxes.

- Building Works: 91,838,990 CFA

- Roads and Utilities Infrastructure : 103,211,000 CFA

- Total excl. VAT: 195,049,990 CFA

- VAT (18%): 35,108,998 CFA

- Total incl. VAT: 230,158,988 CFA

Before launching the works, the company decides to establish a forecasted income statement (FIS) based on the bill of quantities. The contractor plans to complete the project in 7 months. Using the preliminary project schedule, he distributes the estimated consumption of each resource over time, which enables him to capture the estimated financial position at any point in time.

To simplify project monitoring and financial control, he chooses to use PROTRACKBTP, a collaborative construction management platform. Without such a tool, project oversight becomes laborious and error-prone.

Construction Project Cost Categories

- Labor

- Equipment

- Materials

- Subcontractors

- Miscellaneous overheads

Labor Budget

Materials Budget

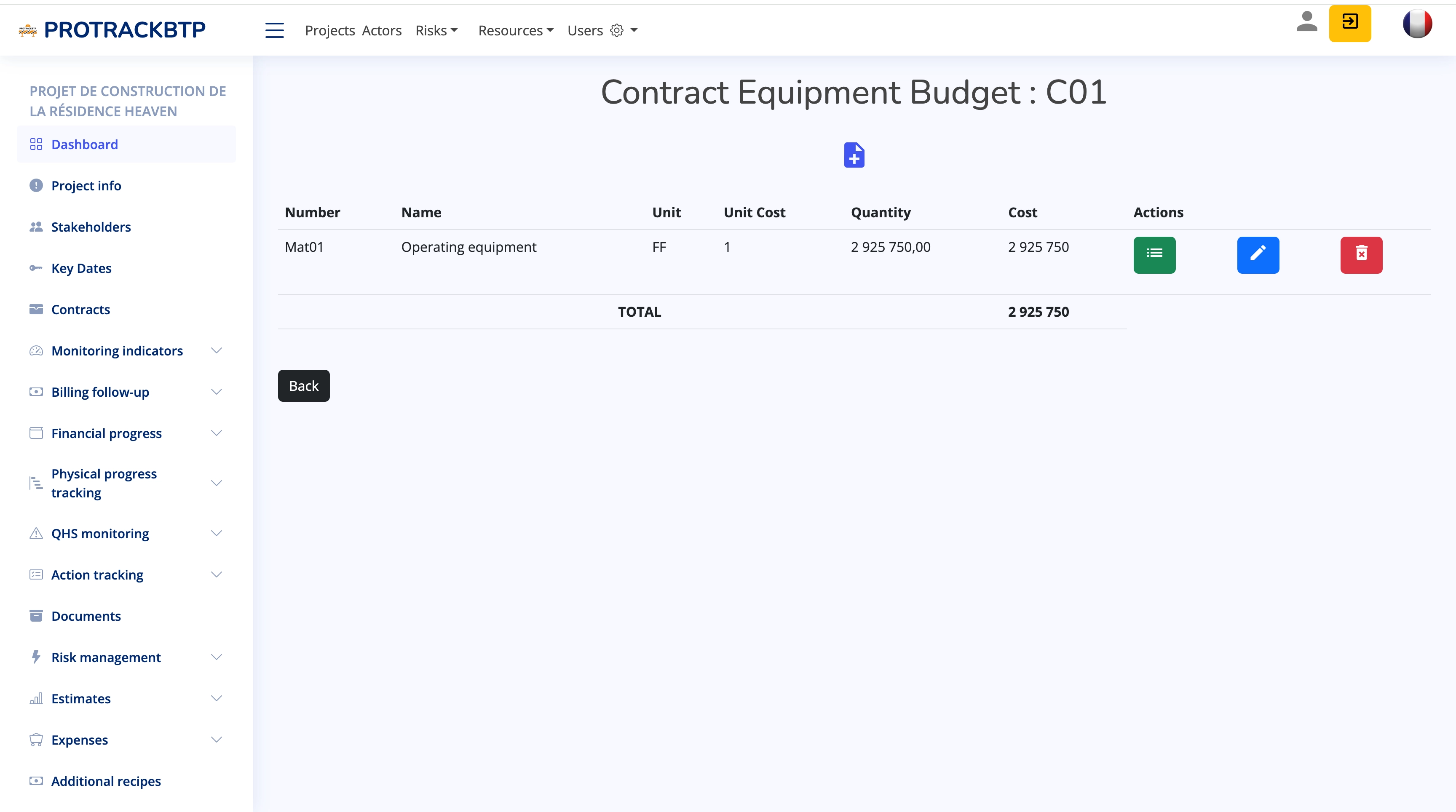

Equipment Budget

Subcontractor Budget

Miscellaneous Expenses

Revenue Forecasts

Once all projected revenues and costs are entered into PROTRACKBTP, each item can be linked to a consumption timeline. This allows the contractor to compare the forecasted profit margin with the actual margin at any point in time.

The tool also enables the tracking of specific resource usage (e.g., cement, diesel) and helps identify discrepancies that could impact profitability.

Forecasted Income Statement

The contractor generates the Forecasted Income Statement (FIS).

At the end of the project, the forecasted margin is 36,995,225 CFA.

Using PROTRACKBTP’s search and analysis features, he can view the margin forecast at a given date—for example, on May 31, 2024, the projected margin is 10,724,105 CFA.

Real-Time Tracking and Role-Based Collaboration

With the FIS in place, the contractor begins daily tracking of project execution. PROTRACKBTP allows multiple users with distinct roles to collaborate efficiently:

- Material handler logs deliveries and usage of resources.

- Site manager tracks production and updates work progress daily or weekly.

As a result, the actual income statement is updated in real time and compared against the forecast.

Cost Tracking and Material Consumption

All actual costs are allocated to the project with unit prices. For example, the materials list includes itemized records of usage and cost.

For example, here is the breakdown of cement consumption.

Production monitoring

The original estimate is imported into PROTRACKBTP. This allows the contractor to track financial progress by comparing planned vs. executed quantities.

Quote

Financial progress report as of 07/31/2024

Real Income Statement: A Reality Check

Once the costs and production are entered into PROTRACKBTP, the real-time operating statement for the project is automatically obtained, which is compared with the forecast values for a given date.

For example, as of May 31, 2024, we saw previously that the forecast margin is 10,724,105 FCFA.

The actual situation is as follows:

By May 31, 2024, while the forecasted margin was 10,724,105 CFA, the actual margin is only 5,386,608 CFA, despite production reaching 100,925,024 CFA, exceeding the forecast of 87,000,000 CFA.

A deeper look at the costs reveals the issue: forecasted total costs were 76,275,895 CFA, while actual costs rose to 95,538,416 CFA.

Material overruns are clearly visible—especially for cement, rebar, gravel, and sand. For instance, cement costs amounted to 7,200,000 CFA instead of the forecasted 4,875,000 CFA.

This demonstrates how real-time financial tracking helps identify issues early. If nothing is done, the project could end in a loss.

Conclusion

Creating an objective and well-prepared Forecasted Income Statement (FIS) offers numerous benefits:

- Better control of essential costs

- Early alerts for high-risk materials like cement, steel, and fuel

- Reliable budgeting for procurement and subcontracting

- Accurate profit margin forecasting to avoid overspending

- Improved cash flow management

Unfortunately, many companies only perform cost analysis at the end of a project—often too late to act. With PROTRACKBTP, contractors can:

- Monitor income statements in real time

- Compare actual vs. forecasted figures

- Make corrections before profit margins are affected

💡 Ready to try PROTRACKBTP for free?

👉 Visit: https://www.protrackbtp.com

(This article is adapted from a chapter of El Hadj Mamadou Fall’s book: Quantitative Management Techniques Applied to the Construction Sector.)

PROTRACKBTP

PROTRACKBTP